|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

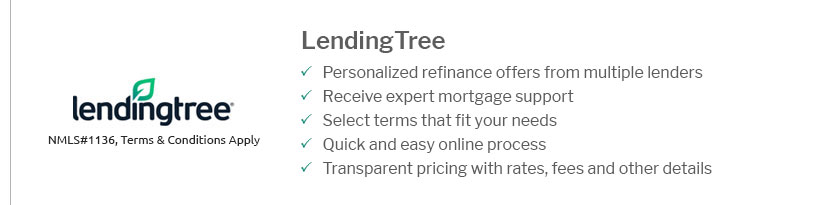

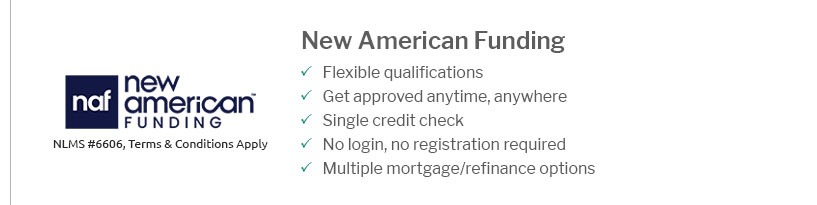

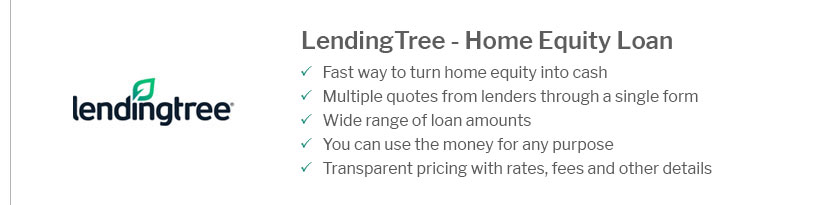

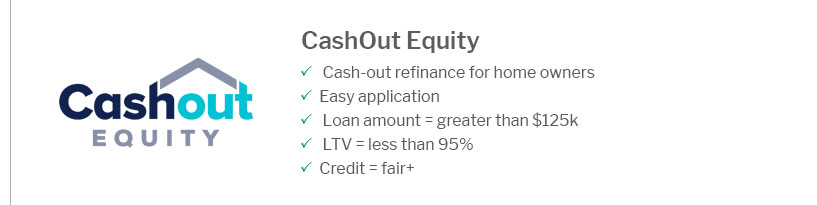

The Best House Refinance Companies: What to Consider and ExpectRefinancing your home can be a strategic financial move, but choosing the right company is crucial. In this guide, we will explore the best house refinance companies and what you should consider when selecting one. Top Factors to ConsiderWhen looking for a refinance company, it's important to evaluate several factors to ensure you get the best deal. Interest RatesInterest rates are a significant factor in determining the overall cost of your refinance. Compare rates from different companies to find the most competitive offer. Fees and Closing CostsDon't overlook fees and closing costs, as they can add up quickly. Some companies may offer low rates but high fees, so it's essential to balance these factors. Highly Recommended Refinance CompaniesHere are some refinance companies known for their excellent services and competitive rates.

Understanding the ProcessThe refinancing process can be complex, but understanding the steps can help you navigate it smoothly. For more on the fha streamline refinance process, you can visit detailed guides that explain each step. Benefits of RefinancingRefinancing can offer several benefits, including reduced monthly payments, lower interest rates, and the ability to switch from an adjustable-rate to a fixed-rate mortgage. Saving Money Over TimeBy securing a lower interest rate, you can save a significant amount of money over the life of the loan. This is especially true if you plan to stay in your home for many years. Accessing EquityRefinancing can also provide access to your home's equity, which can be used for home improvements or other expenses. To understand more about the fha streamline refinance meaning, explore resources that offer in-depth explanations. FAQ

https://finance.yahoo.com/personal-finance/mortgages/article/best-cash-out-refinance-lenders-134200722.html

Truist is a mortgage provider that leaves little to be desired. It offers lots of cash-out refi choices and lower-than-median loan costs. https://money.usnews.com/loans/mortgages/mortgage-refinance-lenders

A mortgage refinance replaces your original mortgage with a new one, ideally with a lower interest rate. You'll get a new interest rate and other loan terms. https://lendedu.com/blog/best-mortgage-refinance-companies/

Reviews of the best refinance lenders. The LendEDU team found that SoFi, Rocket Mortgage, Quicken Loans, and Navy Federal Credit Union are the ...

|

|---|